. . but, first, a Mother’s Day Bouquet for Mama G. :

2 of 180

A Conversation We Might Have Over-Heard at Mohawk Harbor on Mother’s Day:

Q: “What are all those big yellow things called, Son?” A: “Bollards, Mom.”

Q: “Why are there so many and why are they so tall?” A: “Only God, Ray Gillen, and maybe Mayor McCarthy, know”.

Q: “Weren’t they supposed to make Mohawk Harbor and the Casino a classy, attractive destination?” A: “That’s what they promised.”

Q: “Then, how the heck did all those yellow bollards get here?”

“They” — the Developer Galesi Group, Casino Owner Rush Street Gaming, the Planning Commission, Mayor Gary McCarthy and City Hall in general, Ray Gillen and Metroplex, and County government — could have and should have made this crucial project more attractive, to help bring in tourists and repeat business, and for the sake of residents who deserve a beautiful harbor district. Instead, there are, by my recent count, at least 180 bright yellow bollards (that is,15 dozen) surrounding Rivers Casino and detracting from its attractiveness.

The bollards are, in addition, taller than the average bollard (which is 3.5 ft., and not 4′, 5′ and 6′, as at Mohawk Harbor), increasing their visual impact.[see photo above] In the opinion of many folks in Schenectady, parking areas and pedestrian walkways should not be this pedestrian.

The Sentries assigned to protect Schenectady from harmful outsiders on the day of the 1690 Schenectady Massacre instead went off to a Mill Lane pub for some brew, leaving behind snowmen and open stockade gates to greet French and Indian marauders from Canada. Sadly, it seems, weaponless and voiceless Snowmen have been appointed or hired to oversee design and implementation of Schenectady’s most important development of this Century. They’ve permitted a bumper crop of bright yellow bollards to sprout along Mohawk Harbor. For my taste, if they had spawned at least a few snowman-shaped bollards, we would have been better off.

The Sentries assigned to protect Schenectady from harmful outsiders on the day of the 1690 Schenectady Massacre instead went off to a Mill Lane pub for some brew, leaving behind snowmen and open stockade gates to greet French and Indian marauders from Canada. Sadly, it seems, weaponless and voiceless Snowmen have been appointed or hired to oversee design and implementation of Schenectady’s most important development of this Century. They’ve permitted a bumper crop of bright yellow bollards to sprout along Mohawk Harbor. For my taste, if they had spawned at least a few snowman-shaped bollards, we would have been better off.

You can see the results of the City’s planning and oversight omissions for yourself with a quick look at the next two collages; one shows bollards at Rivers Casino at Mohawk Harbor on the west side of the facility [L], and the other shows bollards along the east end and rear of the Casino complex [R].

. . click on either collage, or any image in this posting, for a larger version .

What Is a Bollard and What Do They DO?

A bollard is a sturdy, short, vertical post. The term originally referred to a post on a ship, wharf or dock used principally for mooring boats, but is now also used to refer to posts installed to control road traffic and posts designed to provide security and prevent ramming attacks, as well as provide a theme or sense of place. [see Wikipedia; Reliance Foundry; TrafficGuard.]

A bollard is a sturdy, short, vertical post. The term originally referred to a post on a ship, wharf or dock used principally for mooring boats, but is now also used to refer to posts installed to control road traffic and posts designed to provide security and prevent ramming attacks, as well as provide a theme or sense of place. [see Wikipedia; Reliance Foundry; TrafficGuard.]

Bollards are available in many different sizes and styles, including removable or fixed versions, designed to evoke virtually any era or taste. The type chosen depends on the purpose of the bollard, and the location. For example, Reliance Foundry displays illustrations, specs, and prices for 143 bollard models at its website, including bollard covers in many styles and choice of materials. And, see: its Pinterest Creative Bollards display. Bollards can be serious or stately, artsy or whimsical. The style or mood can even be mixed on the same site or project.

Bollards are not, therefore, merely practical, and definitely do not have to detract from a landscape or streetscape. Reliance Foundry notes that “Bollards enhance the visual quality of buildings and landscapes while providing visual and physical barriers for safer, more controlled environments.” And, relevant to our discussion of Mohawk Harbor and Rivers Casino:

Bollards are not, therefore, merely practical, and definitely do not have to detract from a landscape or streetscape. Reliance Foundry notes that “Bollards enhance the visual quality of buildings and landscapes while providing visual and physical barriers for safer, more controlled environments.” And, relevant to our discussion of Mohawk Harbor and Rivers Casino:

When used to complement new or existing architecture, bollards can create or reinforce thematic visual cues and enhance a sense of place within a neighborhood or community—and for approaching visitors. [click the collage at the head of this blurb to see samples of Reliance Foundry bollards]

When used to complement new or existing architecture, bollards can create or reinforce thematic visual cues and enhance a sense of place within a neighborhood or community—and for approaching visitors. [click the collage at the head of this blurb to see samples of Reliance Foundry bollards]

Despite the hundreds of bollard styles to choose from, and their coincidental nautical history, tall bollards with bright yellow covers are so ubiquitous on the lawns, parking areas, and walkways of Schenectady’s Rivers Casino, that they are the most prominent architectural feature defining the otherwise uninspiring, and unnamable external design of the Casino complex.

Despite the hundreds of bollard styles to choose from, and their coincidental nautical history, tall bollards with bright yellow covers are so ubiquitous on the lawns, parking areas, and walkways of Schenectady’s Rivers Casino, that they are the most prominent architectural feature defining the otherwise uninspiring, and unnamable external design of the Casino complex.

Thus, whether you are . . .

. . entering the Rivers Casino parking lot from the west on Front Street:

. . coming from the east on Harbor Way:

. . . visiting next-door at STS Steel:

. . driving over the Mohawk from Glenville on Freeman’s Bridge:

. . .

. . .

. . aboard your yacht on the Mohawk River:

. . .

. . entering the ALCO Trail on foot from the west:

. . or, even checking out the ALCO Trail signage from your bike:

your first and subsequent views of the site at Rivers Casino are highly likely to be populated by an inert army of tall, bright yellow bollards.

WE DESERVE(D) BETTER

In the posting “Why does Rush Street give Schenectady its scraps” (June 19, 2015), we pointed to the image created by the Applicants before the Location Board, when they sought a gaming license from New York State, and noted our disappointment in the eventual design of Rivers Casino:

A flashy digital brochure submitted to the New York State Gaming Commission, “The Companies of Neil Bluhm,” touts his having “developed and acquired over $50 billion in world class destinations,” his “Establishing international beacons to successfully attract the tourism market,” and “placing an emphasis on superior design” for his casinos. Unfortunately, instead of an “international beacon” like Fallsview Casino in Ontario, Canada, we get a design that reminds us Neil Bluhm “pioneered . . . the creation of urban shopping centers.”

Why did we get such a disappointing, second-rate design? I got no reply when I emailed the Schenectady Planning Office and City Engineer, on April 15, 2019 and asked, regarding the yellow bollards:

- Did the Applicant designate the color, style and size for its bollards for its Site Plan review?

- Did the Commission either approve or direct such bright yellow bollards?

- Did Staff review this choice and okay it?

That leaves me to speculate on my own. In our June 15, 2017 “scraps” posting, we stated:

Our first guess as to why Rush Street does not try very hard for Schenectady is that it has had our “leaders” fawning over it ever since the first rumor of a casino was in the air early last year. This morning’s Schenectady Gazette suggests another reason: As with the earlier zoning amendments, the normal Planning Commission process has been aborted (hijacked?), with the skids greased by the Mayor to make sure Galesi and Rush Street never have to wait very long to get their wish list fulfilled, and with public input stifled whenever possible.

In their Casino License Application, Rush Street Gaming and the Galesi Group were required to submit detailed renderings and sketches of the proposed Casino project. For example, the July 2014 Application included an overview sketch with the detail at the right of their west parking lot, the largest ground-level parking area. [full sketch] There are well over 100 trees in the west parking lot in the submitted sketch. That presentation shows that the Applicants/Developer/Owners knew what a parking lot meant to attract and keep tourists and other customers should look like. If nothing else, the image should also have reminded the Planning Commission and planning staff what their goal should be regarding the landscaping and appearance of this prime location. Unfortunately, the public and perhaps also the Planning Commission never again saw such detailed proposals for the casino compound.

In their Casino License Application, Rush Street Gaming and the Galesi Group were required to submit detailed renderings and sketches of the proposed Casino project. For example, the July 2014 Application included an overview sketch with the detail at the right of their west parking lot, the largest ground-level parking area. [full sketch] There are well over 100 trees in the west parking lot in the submitted sketch. That presentation shows that the Applicants/Developer/Owners knew what a parking lot meant to attract and keep tourists and other customers should look like. If nothing else, the image should also have reminded the Planning Commission and planning staff what their goal should be regarding the landscaping and appearance of this prime location. Unfortunately, the public and perhaps also the Planning Commission never again saw such detailed proposals for the casino compound.

-

from 2nd Casino Design

The limited 2nd design images submitted for public review of the Casino compound did not include the full parking lot, but still seemed to have quite a few trees. [See the image to the left.] The third design submitted to the public only revealed a tiny part of the front and back of the Casino, giving no parking lot views. Of course, nothing prevented, and their duty demanded, that the Planning Commission require more detail and allow more public comment; more important, their duty demanded the construction of far more attractive parking lots, especially given how much of the total footprint of the Casino Compound and Mohawk Harbor they would consume.

The the next four images below show the actual west parking lot, with its mere handful of trees along the rows. Click on a photo for a larger version.

. .

. .

. . photos taken, Nov. 4, 2018 [above] and May 4, 2019 [below] . .

. .

. .

You have to wonder: “What happened to all those trees?” Indeed, the Minutes of the July 22, 2015 Commission Meeting, which included the Casino Site Plan Review, have Commission Member (now Chair) Mary Moore Wallinger noting (at 5):

[T]hat she very much appreciates the detailed planting plan and that she feels that the applicants listened to the feedback from the Commission regarding the landscaping and pedestrian walkways and took it into account when revising the design.

[T]hat she very much appreciates the detailed planting plan and that she feels that the applicants listened to the feedback from the Commission regarding the landscaping and pedestrian walkways and took it into account when revising the design.

What could Ms. Wallinger, a leading Schenectady landscape architect and designer of major municipal projects in the City and County, have meant, if the result is a swarm of yellow bollards that would seem to be the antithesis of good landscaping and site planning at an “international tourist destination” and unique, new, upscale neighborhood? The beauty and shade added by robust and numerous trees in a parking lot are, of course, much appreciated by urban designers, and by passersby, drivers, and passengers coming from near and far.

- BTW: I recall being in the Commission hearing room when, at one point in the process, Ms. Wallinger spent a lot of time worrying with the applicant over the size of the parking lot tree beds. Did she have any follow-up with the Planning Office staff on this issue?

Throughout the Casino design and site plan approval process, this website and local media complained that the public and the Planning Commission were receiving far fewer and far less specific details about how the casino site would look as proposed by the developers than we would expect in even the most insignificant project. We were shown only incomplete “peeks” at segments of the proposed plans, often with sketches and not complete renderings, and the Commission never demanded more, despite the importance of this project and its clear authority to require more. Instead, phony deadline pressure arguments from the Applicants were accepted without complaint, and last-minute incomplete submissions were accepted. For example, see the limited-view renderings submitted for the rear (river-side) of the Casino and its Hotel on the Right for the 2nd Rivers Casino Design, and immediately below for the 3rd design.

Throughout the Casino design and site plan approval process, this website and local media complained that the public and the Planning Commission were receiving far fewer and far less specific details about how the casino site would look as proposed by the developers than we would expect in even the most insignificant project. We were shown only incomplete “peeks” at segments of the proposed plans, often with sketches and not complete renderings, and the Commission never demanded more, despite the importance of this project and its clear authority to require more. Instead, phony deadline pressure arguments from the Applicants were accepted without complaint, and last-minute incomplete submissions were accepted. For example, see the limited-view renderings submitted for the rear (river-side) of the Casino and its Hotel on the Right for the 2nd Rivers Casino Design, and immediately below for the 3rd design.

. . .

By the way, despite their prominence on the actual constructed site, there are no yellow bollards in sight in either version of the rear of the Casino complex.

How could this happen at a project hailed so often as Schenectady’s premiere new, upscale location, and hope for its future? The City’s Planning Commission purportedly gave the Casino and Mohawk Harbor a full Site Plan Review (see our disappointed coverage). Site Plan review is not merely meant to make sure that all zoning laws have been followed. As we explained during the Site Plan process for the Casino complex in July 2015:

How could this happen at a project hailed so often as Schenectady’s premiere new, upscale location, and hope for its future? The City’s Planning Commission purportedly gave the Casino and Mohawk Harbor a full Site Plan Review (see our disappointed coverage). Site Plan review is not merely meant to make sure that all zoning laws have been followed. As we explained during the Site Plan process for the Casino complex in July 2015:

“[T]he commission has the ability to evaluate the aesthetic visual impact of the project even if the plans satisfy zoning requirements.” [Gazette article citing Corporation Council Carl Falotico, Feb. 3, 2015.]

Also, see the section “What a site plan accomplishes” in the “BEGINNER’S GUIDE TO LAND USE LAW”, by the Land Use Law Center of Pace University School of Law, at 19.

-

- By the way, at the end of the July 22, 2015 Planning Commission Meeting, chair Sharron Coppola announced it would be her last meeting as chair, and that she would be resigning her position as Planning Commissioner. I certainly wish Ms. Coppola had written a Memoir of her time at the Commission, including the entire Harbor District zoning and Casino site planning experience.

POSSIBLE EXPLANATIONS?

at OrthoNY Liberty Street

Some of the most imaginative people I know have not been able to figure out or conjure up a justification for the excessive and near-exclusive use of bright yellow bollards at Rivers Casino Schenectady. In addition, in none of my readings have I found any indication that bollards need to be bright yellow in order to effectively serve their functions. My inquiry to City Engineer Chris Wallin about requirements that bollards be yellow in certain situations never got a reply. (Of course, in a location where one might not expect to find the protected item, a bright color to signal its existence does make sense, but that issue does not seem to warrant the ubiquitous choice of bright yellow at Rivers Casino at Mohawk Harbor.)

A Schenectady Tradition? No, it isn’t, despite their use to protect utility cabinets at recent projects downtown. City Hall, County, civic and business leaders are surely aware that there are other kinds of affordable and more attractive bollards, or similar security measures or screens available. A short outing around Downtown Schenectady should suffice to prove that proposition; here’s the result of my recent bollard tour:

at S. Church & State St. . .

Also, the first tenant at Mohawk Harbor, Courtyard by Marriott Hotel, did a nice job looking like a tasteful place to stay, without using even one yellow bollard to protect the building and utility units. Here are a couple of sample views of the Hotel; for more, click on the Collage Thumbnail to the head of this paragraph.

Also, the first tenant at Mohawk Harbor, Courtyard by Marriott Hotel, did a nice job looking like a tasteful place to stay, without using even one yellow bollard to protect the building and utility units. Here are a couple of sample views of the Hotel; for more, click on the Collage Thumbnail to the head of this paragraph.

. .

. .

Unfortunately, Marriott’s example did not rub off across its driveway at Galesi’s Harborway Drive office-retail buildings.

A Rush Street Gaming Branding Tool or Trademark? And, No, bright yellow bollards are not a design theme uniting all Rush Street Gaming properties. The collage below (on L) has images compiled from an extensive on-line Google Street Map tour of the exterior of Rivers Casino at DesPlaines, Illinois, which has a design similar in many ways to Schenectady’s Rivers Casino, but without yellow bollards. Similarly, the collage on the Right shows exterior scenes from Rush Street’s Sugar House Casino in Philadelphia, where yellow bollards are also absent and do not appear to be a design element for exterior spaces. Similarly, Google Images we located of Rivers Casino Pittsburgh contain no yellow bollards.

Furthermore, Rush Street Gaming and their development partner Galesi Group used not-yellow bollards and non-bollard alternative devices in strategic spots at and near Rivers Casino. Click on this Collage:

. .

A few years ago, we documented at this website how much better Rush Street Gaming has treated the cities that host its other casinos or potential sites than how it treats Schenectady [see, e.g., Rush Street Giveaways, and Money on the Table]. So, it is not surprising that we have not been able to find similar aggregations of bright yellow (or even similarly unsubtle or unsightly) bollards at other Rush Street casinos.

at Waterfront Condominiums, Mohawk Harbor

Finally, Is Bright Yellow a Galesi Group Trademark or Branding Tool? Despite a minor outbreak of similar bollards at the Galesi-built and owned Price Chopper/Golub headquarters (example), there does not seem to be any internal imperative for yellow bollards within the Galesi Group. Indeed, we see a far more tasteful/tolerable (and less conspicuous) set of bollards at the eastern end of Mohawk Harbor, performing protection service for utility cabinets and similar objects at Galesi’s high-end Waterfront Condominiums [asking price, $500,000 to $700,000]. There’s not a yellow bollard in sight on site.

Like the westside of Mohawk Harbor, the eastside (between Harborside Drive and Erie Boulevard), sits on the banks of the Mohawk River, has a bike-pedestrian path running through it, and features ALCO Heritage signage sponsored by Schenectady County. Both ends of Mohawk Harbor sit within the City of Schenectady, with site plans reviewed by its Planning Commission. And, both ends were proudly godfathered/mid-wived by Ray Gillen of Metroplex. Why such a visually-different result?

. . Mohawk Harbor riverbank bollards protecting utility boxes: [above] at Rivers Casino; [below] at Waterfront Condominiums . .

- Discount Bollards? Did a literal bargeful of yellow bollards or bollard covers show up at Mohawk Harbor or another Schenectady County location with great price breaks for buying them in bulk? What amount of savings could compensate for their lack of aesthetic virtue?

- Peoples’ Choice? I know that taste can be very subjective, and that some “leaders” want to force constituents out of their confined preferences, but I believe that the great majority of Schenectady area residents, if asked the question directly with photos, would strongly prefer non-yellow bollards.

As with the failure of our Mayor to demand financial, employment, purchasing benefits, etc., in a host community agreement, it appears that our City Hall and its appointed Civil Snowmen neither demanded attractive landscaping and protective installations around the Casino, nor required that the developers fulfill any specific promise they may have made in the site plan process.

The collage to the Right gives a stark example of Galesi Group promises in a site plan meeting that were apparently later ignored by the developer and by any enforcement officials reviewing the execution of a Mohawk Harbor project. According to June 17, 2015 Planning Commission Meeting Minutes, during review of the Site Plan for what would become the 220 Harborside Drive office and retail building, project engineer Dan Hershberg:

The collage to the Right gives a stark example of Galesi Group promises in a site plan meeting that were apparently later ignored by the developer and by any enforcement officials reviewing the execution of a Mohawk Harbor project. According to June 17, 2015 Planning Commission Meeting Minutes, during review of the Site Plan for what would become the 220 Harborside Drive office and retail building, project engineer Dan Hershberg:

.

[E]xplained that because there is underground parking beneath the parking lot, landscaping option are more limited in this space.He stated that large planters are proposed for the islands in the parking lot, and that they will be cast in concrete on site and will be quite substantial in size. He added that they are proposing to add trees to the site wherever possible, but there are some spots where easements are located which will be planted with more seasonal, less permanent options. [emphasis added]

.

There are, as you can see in the collage above, no islands, no planters, and no trees. Who in our City government is responsible to follow-up on such matters?

Why is this Bargeful of Bollards Story Important? It is a prime,  very visible example of The Snowman Effect: The inadequate protection of the public interest in Schenectady, due to the appointment and retention at City Hall by Mayor Gary McCarthy of subservient, ineffectual or disinterested public servants (with dismissal of those who do not cooperate), resulting in both rushed, superficial review of submissions from favored applicants, and lax follow-up and enforcement of City Code provisions and applicant promises. [as symbolically depicted here] It has meant, in the Casino Design and Yellow Bollards context, suffering a less attractive and less successful Rivers Casino in Schenectady, and in other contexts, such as the ALCO Bike-Pedestrian pathway, a less safe Mohawk Harbor for those who visit and use the facilities (see this and that).

very visible example of The Snowman Effect: The inadequate protection of the public interest in Schenectady, due to the appointment and retention at City Hall by Mayor Gary McCarthy of subservient, ineffectual or disinterested public servants (with dismissal of those who do not cooperate), resulting in both rushed, superficial review of submissions from favored applicants, and lax follow-up and enforcement of City Code provisions and applicant promises. [as symbolically depicted here] It has meant, in the Casino Design and Yellow Bollards context, suffering a less attractive and less successful Rivers Casino in Schenectady, and in other contexts, such as the ALCO Bike-Pedestrian pathway, a less safe Mohawk Harbor for those who visit and use the facilities (see this and that).

For more on the Snowman Effect, see “McCarthy only wants snowmen on the Planning Commission“. For an explanation of the Snowmen Metaphor, see our posting “have we learned the lessons of the 1690 Schenectady Massacre?”; for examples, some of which are more subtle than others, check our postings in the Snowmen Effect Category.

For more on the Snowman Effect, see “McCarthy only wants snowmen on the Planning Commission“. For an explanation of the Snowmen Metaphor, see our posting “have we learned the lessons of the 1690 Schenectady Massacre?”; for examples, some of which are more subtle than others, check our postings in the Snowmen Effect Category.

The unspoken attitude of our Mayor and the Metroplex Chair seems to be that Schenectady is the old Mohawk term for “Second-Rate-City“. Consequently, they have failed to demand, or at the least strenuously bargain for, the best for our City from Rush Street Gaming and the Galesi Group. The result is a tremendous lost opportunity for Schenectady to truly shine and succeed at our only remaining riverbank land suitable for commercial development and public recreation. The bollard crop along the Mohawk also suggests that Schenectady’s Snowmen/women are not merely on the Boards that review projects, but also in the offices that are supposed to see that reviewed plans are implemented as approved or as promised by an applicant. The situation with readily visible aspects of Mohawk Harbor also makes us wonder what is going on with items that are not readily seen by the public (such as the “shoddy work” recently alleged at a Harborside Drive building).

Having beget a “bummer” crop of bright, yellow, too-tall* bollards, the same municipal officials now stand as mute as snowmen when Rivers Casino complains that it is losing business because of an unfair tax structure compared to its competitors, and seeks tax breaks that would cost the City hundreds of thousands of dollars a year in lost revenue. See “Rush Street must think we are all pretty stupid.”] Leaders and residents should instead point out that one very big reason Rivers Casino finds it hard to compete is that they have built a homely, mediocre, regional gambling facility, with the acquiescence and cooperation of City Hall and Metroplex, despite the promise to create an international tourist attraction for Schenectady.

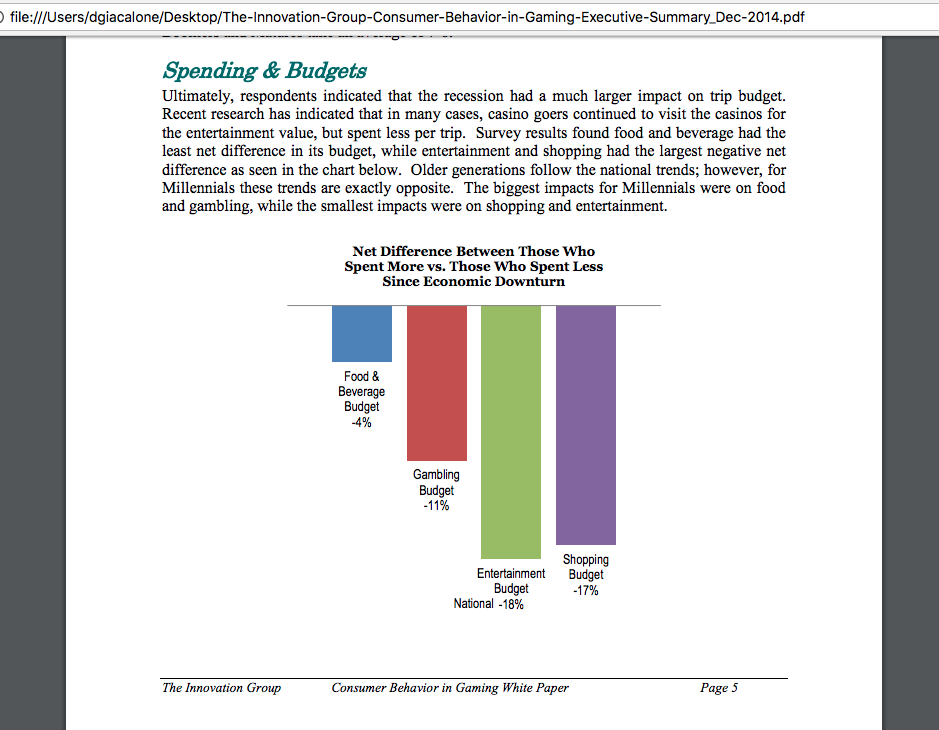

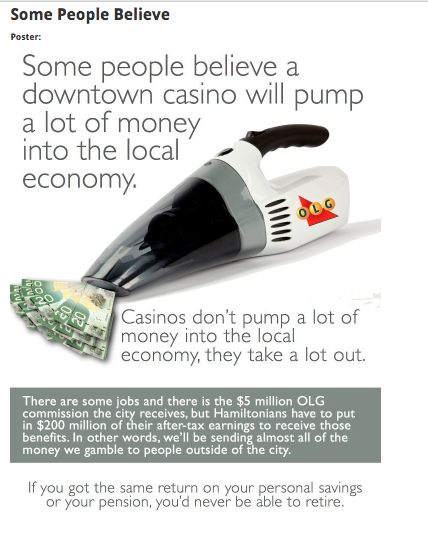

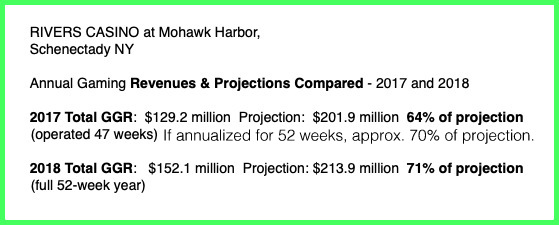

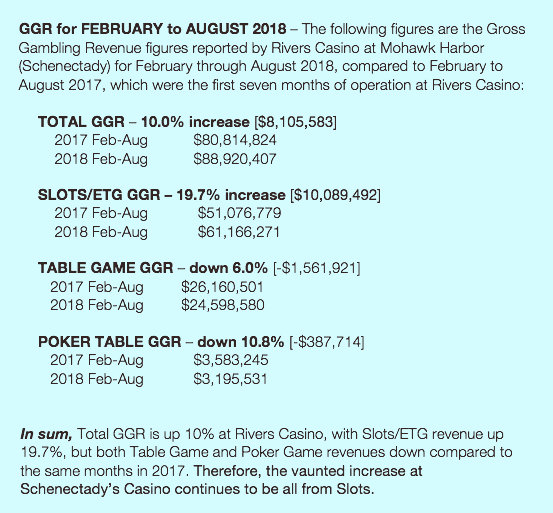

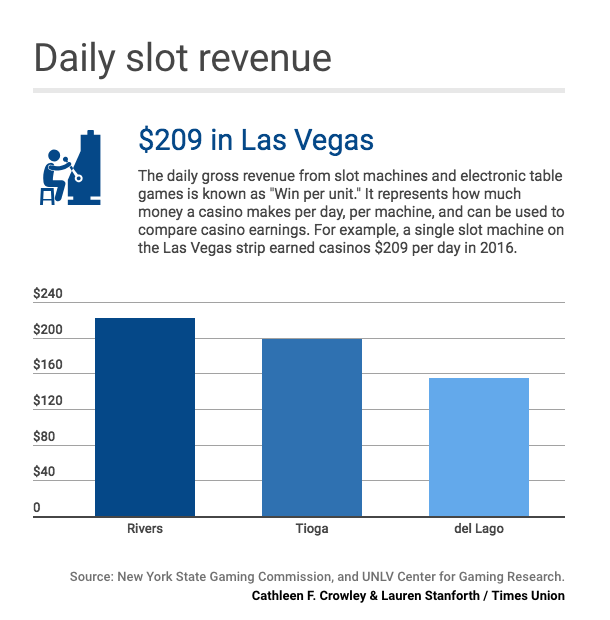

- Financial Realities. Rush Street does not have to meet its bloated projections for Rivers Casino in Schenectady to prosper on the Mohawk. Failing to attract visitors beyond a small geographic radius, Rivers Casino seems content to focus on: Seeking tax breaks; Slots (the most addictive form of casino gambling) as the focus of its gaming growth; Sports gambling (which might siphon off gambling dollars that are taxed at a much higher rate); and attracting Non-gambling spending at the Casino, which helps the bottomline of Rush Street and its associated enterprises, but reduces gaming tax revenue to the State, County and City, and hurts other local businesses. And, City Hall and The County Building seem content with this situation, continuing to call the Casino their Partner.

New Attitude Needed. Schenectady’s government leaders disarmed themselves when dealing with the Casino applicants, giving away leverage that could have assured many additional benefits for the City and County and its residents, like The Giveaways Rush Street has made or promised other prospective casino towns. They will have few if any comparable opportunities, now that the project design and the zoning changes demanded by the Applicants have been approved. Nevertheless, a new attitude that, at the very least, asserts the position of Senior Partner for local government can hopefully salvage a few benefits, avoid some disadvantages, and help restore some civic pride.

New Attitude Needed. Schenectady’s government leaders disarmed themselves when dealing with the Casino applicants, giving away leverage that could have assured many additional benefits for the City and County and its residents, like The Giveaways Rush Street has made or promised other prospective casino towns. They will have few if any comparable opportunities, now that the project design and the zoning changes demanded by the Applicants have been approved. Nevertheless, a new attitude that, at the very least, asserts the position of Senior Partner for local government can hopefully salvage a few benefits, avoid some disadvantages, and help restore some civic pride.

Continue reading →

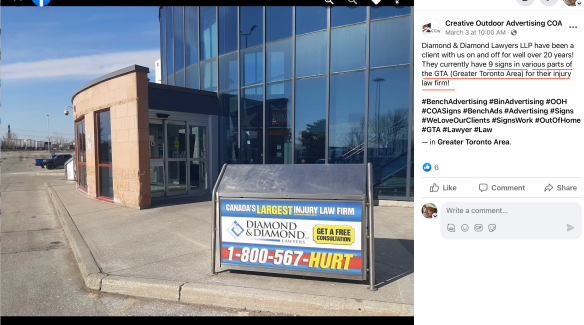

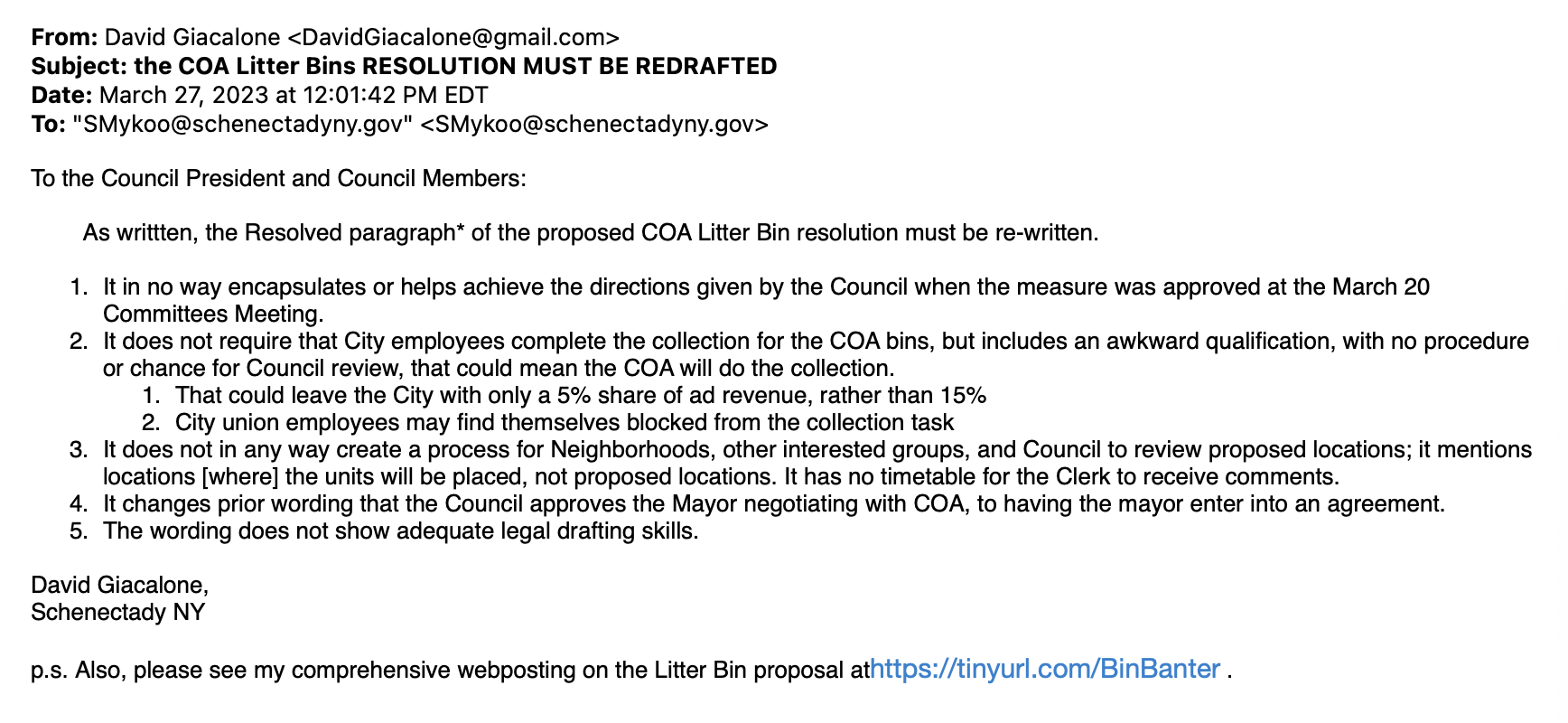

. . above and below, examples of COA recycling centers presented in COA sales materials . .

. . above and below, examples of COA recycling centers presented in COA sales materials . .  The Gazette has made the situation worse by changing its March 7 original, online headline from, “Schenectady council considers proposal to acquire ad-supported garbage bins”, which is informative and neutral, to the accusatory “Council slow walks plans for garbage bins”, in the March 8 newsprint version. Neither version of the article mentions the size of the proposed bins.

The Gazette has made the situation worse by changing its March 7 original, online headline from, “Schenectady council considers proposal to acquire ad-supported garbage bins”, which is informative and neutral, to the accusatory “Council slow walks plans for garbage bins”, in the March 8 newsprint version. Neither version of the article mentions the size of the proposed bins. . . are these COA scenes analogous to the urban locations in Schenectady that have the most need of Litter Reform?

. . are these COA scenes analogous to the urban locations in Schenectady that have the most need of Litter Reform? Mr. Polimeni has not explained why the giant bins will improve the behavior of Litter scofflaws or attract litter more effectively than traditional litter recepticles. His best explanation, as far as I have discovered is this gem:

Mr. Polimeni has not explained why the giant bins will improve the behavior of Litter scofflaws or attract litter more effectively than traditional litter recepticles. His best explanation, as far as I have discovered is this gem:

It sounds like COA makes its line-up of Recycle Centers especially distracting to drivers. That cannot be a good thing. Will the draw be so great that those in City Hall who worship revenue streams urge more and more local businesses to climb aboard a COA bin? And, even ask COA to bring Schenectady into the COA world of advertising benches, marring more and more of the public right of way with insurance, injury law, and pun-ishing proctology ads (see above)?

It sounds like COA makes its line-up of Recycle Centers especially distracting to drivers. That cannot be a good thing. Will the draw be so great that those in City Hall who worship revenue streams urge more and more local businesses to climb aboard a COA bin? And, even ask COA to bring Schenectady into the COA world of advertising benches, marring more and more of the public right of way with insurance, injury law, and pun-ishing proctology ads (see above)?RESOLVED, that the Schenectady City Council authorizes the Mayor or his designee to enter into an agreement with Creative Outdoor Advertising of America, Inc., subject to a provision in the agreement stating that the collection of garbage and recycling from the units will be completed by the designated City staff for such services so long as the City has staff designated for such services, and subject to the Mayor or his designee providing a list of the locations at which the collection units will be placed prior to their placement to the City Clerk.

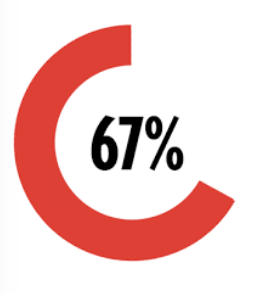

Sports Betting Week 1: $168,743.

Sports Betting Week 1: $168,743. Of course, two weeks may not tell us much. But, Rivers Casino certainly got a lot of publicity for the opening of Sports Wagering in New York State. Fans of legal sports betting might have been expected to rush over to Mohawk Harbor. So far, totals at Rivers Casino suggest less overall revenue and therefore lower tax receipts than prior to the New Age of Sports Betting. If your tummy is easily upset, I’d suggest some dramamine to deal with the Spin Tsunami that may be coming. On the other hand, when it comes to less-than-rosy news about Rivers Casino, we mostly get deafening Silence from Rush Street Gaming, Rush Street Schenectady, and their handmaidens at City Hall, Metroplex, and the County and State Legislatures. Their unwitting public relations departments at our local media tend to run out of words (and follow-up questions), too, when casino news is not good.

Of course, two weeks may not tell us much. But, Rivers Casino certainly got a lot of publicity for the opening of Sports Wagering in New York State. Fans of legal sports betting might have been expected to rush over to Mohawk Harbor. So far, totals at Rivers Casino suggest less overall revenue and therefore lower tax receipts than prior to the New Age of Sports Betting. If your tummy is easily upset, I’d suggest some dramamine to deal with the Spin Tsunami that may be coming. On the other hand, when it comes to less-than-rosy news about Rivers Casino, we mostly get deafening Silence from Rush Street Gaming, Rush Street Schenectady, and their handmaidens at City Hall, Metroplex, and the County and State Legislatures. Their unwitting public relations departments at our local media tend to run out of words (and follow-up questions), too, when casino news is not good. update (Aug. 9, 2019): According to the Rivers Casino

update (Aug. 9, 2019): According to the Rivers Casino

Rush Street Gaming’s billionaire CEO/Owner Neil Bluhm is back walking the halls of the New York State Legislature trying to get a tax break for their

Rush Street Gaming’s billionaire CEO/Owner Neil Bluhm is back walking the halls of the New York State Legislature trying to get a tax break for their  They are again whining about the unfairness of the gaming tax structure, and have bolstered their specious arguments with a flood of misleading statements about their new competitor, MGM Springfield. They are also acting as if an Advertising Allowance tax credit is not a tax break. [follow-up (April 14, 2019): According to the

They are again whining about the unfairness of the gaming tax structure, and have bolstered their specious arguments with a flood of misleading statements about their new competitor, MGM Springfield. They are also acting as if an Advertising Allowance tax credit is not a tax break. [follow-up (April 14, 2019): According to the

Once opening for business, MGM Springfield must make

Once opening for business, MGM Springfield must make

The New York Times article cited above, “

The New York Times article cited above, “

Indeed, from the perspective of potential social costs and harm to gamblers and their families, the situation is very serious. I’ve tabulated the numbers, and it is clear that additional

Indeed, from the perspective of potential social costs and harm to gamblers and their families, the situation is very serious. I’ve tabulated the numbers, and it is clear that additional

It is easy to be flippant and say, “Don’t ask Casino Opponents, we told you so,” back when our elected and appointed political leaders, and businesses hoping for a Casino Gravy Train, refused to even acknowledge the risks. Well, we did tell you so (e.g.,

It is easy to be flippant and say, “Don’t ask Casino Opponents, we told you so,” back when our elected and appointed political leaders, and businesses hoping for a Casino Gravy Train, refused to even acknowledge the risks. Well, we did tell you so (e.g.,

No one should be surprised that the Assemblyman from Mohawk Harbor offers us no Lemonade Recipe and suggests no likely ingredients for the mix (other than a “not-a-bailout” tax break in the form of a marketing allowance that is too silly to even call specious). There is no secret, magical “sugar” to sweeten our Casino Lemons, and no law that will tow the wreck away. We are all left puckering up, and wincing, as the future rushes toward Slotsnectady, a City that once could Light and Haul the World, but now glories in “smart” lamp-posts, its homely-but-bossy Casino, and its beer-cultured Renaissance.

No one should be surprised that the Assemblyman from Mohawk Harbor offers us no Lemonade Recipe and suggests no likely ingredients for the mix (other than a “not-a-bailout” tax break in the form of a marketing allowance that is too silly to even call specious). There is no secret, magical “sugar” to sweeten our Casino Lemons, and no law that will tow the wreck away. We are all left puckering up, and wincing, as the future rushes toward Slotsnectady, a City that once could Light and Haul the World, but now glories in “smart” lamp-posts, its homely-but-bossy Casino, and its beer-cultured Renaissance.

Moreover, revenue

Moreover, revenue

Our July 16, 2018

Our July 16, 2018  One number that jumped out at me from the Rivers Casino report for this past week, ending July 23, 2018, is the total GGR from Table Games: $225,435. That is

One number that jumped out at me from the Rivers Casino report for this past week, ending July 23, 2018, is the total GGR from Table Games: $225,435. That is

My curiosity was piqued, of course, when I saw these words in today’s Gazette article:

My curiosity was piqued, of course, when I saw these words in today’s Gazette article:

update re Chinese New Year (Feb. 23, 2018): Resorts World Catskills

update re Chinese New Year (Feb. 23, 2018): Resorts World Catskills

Naturally, there are many questions about the 1.5 million number (beyond how it was compiled), including how many were day-trippers, who are more likely to spend their entire Schenectady visit within the Casino or perhaps Mohawk Harbor, rather than spending time and money elsewhere. And, how many are residents of Schenectady bringing no new spending to the City (and denying their disposable income and spending on necessities from other Schenectady businesses). The Gazette notes that neither the state nor county will quantify sales tax and hotel occupancy tax revenue generated by the Casino, “out of consideration for the business strategies of those collecting.” That suggests that the media needs to do some digging — beyond the self-congratulatory fog to be expected from the Chamber and Metroplex — to see how businesses outside of Mohawk Harbor are faring.

Naturally, there are many questions about the 1.5 million number (beyond how it was compiled), including how many were day-trippers, who are more likely to spend their entire Schenectady visit within the Casino or perhaps Mohawk Harbor, rather than spending time and money elsewhere. And, how many are residents of Schenectady bringing no new spending to the City (and denying their disposable income and spending on necessities from other Schenectady businesses). The Gazette notes that neither the state nor county will quantify sales tax and hotel occupancy tax revenue generated by the Casino, “out of consideration for the business strategies of those collecting.” That suggests that the media needs to do some digging — beyond the self-congratulatory fog to be expected from the Chamber and Metroplex — to see how businesses outside of Mohawk Harbor are faring.